Published Date : 2025-Apr-17

The lithium battery recycling sector is booming due to rising demand for electric vehicles (EVs), energy storage systems, and stricter sustainability regulations. These companies are pioneering tech-driven recycling solutions like hydrometallurgy and direct recycling.

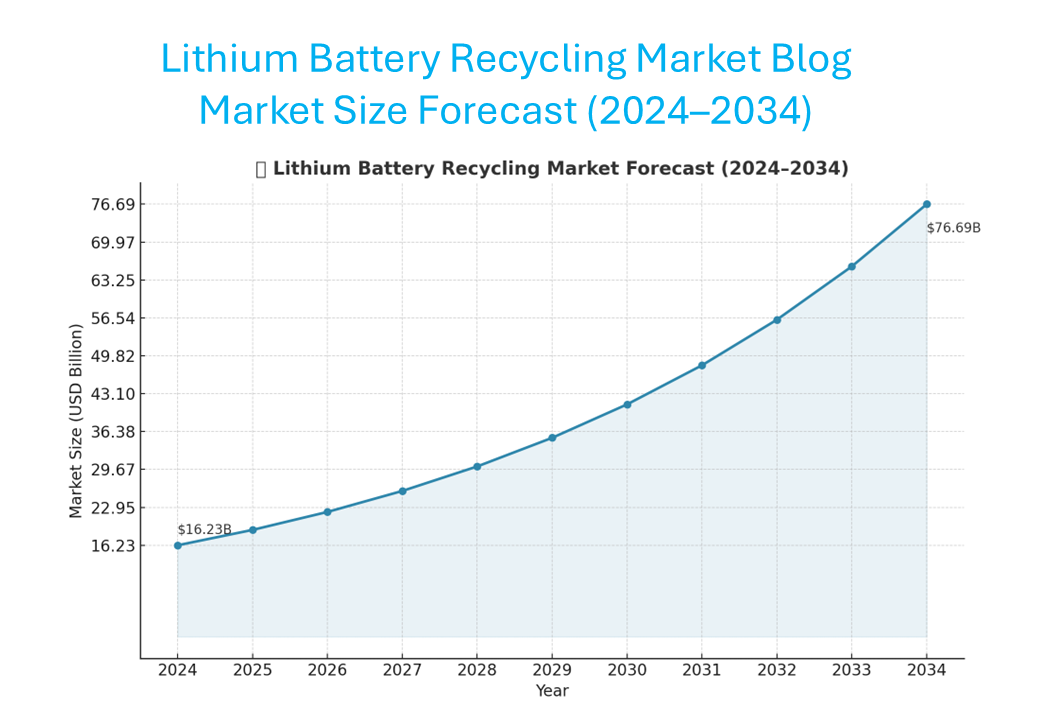

The market is expected to reach a value of USD 76.69 billion by 2034, at a CAGR of 16.8% over the forecast period (2025–2034).

Below is a curated list of the top players.

Global Lithium Battery Recycling Market Size, Share & Trends Analysis Report By Battery Chemistry (Lithium-manganese Oxide (LMO), Lithium-Titanate Oxide (LTO), Lithium-Nickel Manganese Cobalt (Li-NMC), Lithium-iron Phosphate (LFP), Lithium-nickel Cobalt Aluminium Oxide (NCA)), By Sources (Electric Vehicles, Power Tools, Electronics, Others), By Recycling Process (Hydrometallurgical, Pyrometallurgical, Physical/mechanical), By End-User (Mining, Consumer Electronics, Automotive, Industrial, Power, Marine) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America), Global Economy Insights, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast (2025–2034).

The global lithium battery recycling market is growing at a rapid rate, driven by the extensive use of electric vehicles (EVs), renewable energy storage systems, and consumer products. As the demand for lithium-ion batteries surged, the number of used and end-of-life batteries is also increasing, and hence the requirement for recycling as a critical component in the battery lifecycle management. Lithium batteries consume valuable materials such as lithium, cobalt, nickel, and manganese, which are limited materials. Recycling allows salvage of the material for re-use, thereby minimizing raw material treatment reliance and supporting sustainability goals.

Environmental concerns due to improperly disposed lithium batteries are another overarching factor. Lithium batteries pose a serious environmental risk if disposed of inappropriately since they can leak toxic chemicals or catch fire. Governments, regulators, and industry stakeholders are all giving greater weight to the need to develop closed-loop supply chains where used battery materials are recycled back into manufacturing. This not only decreases the environmental impact of battery production but also decreases economic and supply risks of mining and processing of such raw primary materials.

Technological innovations in recycling technology are also revolutionizing the industry. Innovation in new recycling methods like hydrometallurgical, pyrometallurgical, and direct recycling is emerging and being optimized for offering higher recovery yields with lower processing expenses. These technologies are enhancing the efficiency of separation and purification of the components of batteries and thereby making recycling an economically more desirable option. Innovations in battery design are also being promoted to enable disassembly and recovery of materials at the end of a battery's life cycle to be simpler.

Policy incentives and regulation policies are propelling market dynamics development. Governments across the world are creating rules and extended producer responsibility (EPR) schemes to mandate recycling of lithium batteries by collecting them. Policy efforts are encouraging battery manufacturing and OEMs to establish recycling facilities and enter strategic partnerships with recyclers. To the same end, enhanced consumer awareness about environmental sustainability and safe disposal is likewise helping to place a growing quantity of batteries within recycling centres

Though overall outlook is favourable, there are also some limitations for the industry. Complexity and diversity of battery chemistries, initial high capital costs to establish recycling plants, and absence of battery design and collecting practices standardization can limit operational efficiency. Nonetheless, research continues, and all the stakeholders work together towards eliminating these limitations and developing a scalable, circular economy for lithium batteries.

Headquarters: Toronto, Canada

Founded: 2016

Employees: Approx. 400

Revenue (2024): $45+ million

Overview: A leader in resource recovery using proprietary Spoke & Hub technologies.

Key Region: North America

Headquarters: Brussels, Belgium

Founded: 1805

Employees: Approx. 11,000

Revenue (2024): Approx. $4.5 billion

Overview: A pioneer in battery recycling, especially in closed-loop systems.

Key Region: Europe

Headquarters: Nevada, USA

Founded: 2017

Employees: Approx. 400

Revenue (2024): Approx. $100 million (est.)

Overview: Founded by Tesla co-founder JB Straubel, focusing on circular battery supply chains.

Key Region: USA

Headquarters: Jiangxi, China

Founded: 2000

Employees: Approx. 5,000

Revenue (2024): Approx. $6.2 billion

Overview: A vertically integrated lithium giant with advanced recycling capabilities.

Key Region: Asia-Pacific

Headquarters: Lancaster, Ohio, USA

Founded: 1985

Employees: Approx. 250

Revenue (2024): Approx. $30 million

Overview: Among the oldest lithium battery recyclers in North America.

Key Region: USA & Canada

Headquarters: Espoo, Finland

Founded: 1998 (Battery division established 2021)

Employees: Approx. 200 in the battery division

Revenue (2024): Approx. $20 million (battery segment est.)

Overview: Offers low-carbon hydrometallurgical recycling in Europe.

Key Region: Nordic countries & EU

Headquarters: Singapore

Founded: 2005

Employees: Approx. 1,700

Revenue (2024): Approx. $300 million

Overview: Operates across 26 countries with e-waste & lithium battery recycling.

Key Region: Southeast Asia & Europe

Headquarters: Wendeburg, Germany

Founded: 2017

Employees: Approx. 50

Revenue (2024): Approx. $10 million (est.)

Overview: Known for low-CO2 mechanical and hydrometallurgical processes.

Key Region: Germany & EU

Headquarters: Gunsan, South Korea

Founded: 2000

Employees: Approx. 800

Revenue (2024): Approx. $200 million

Overview: Strong R&D focus and international partnerships.

Key Region: South Korea & Southeast Asia

Headquarters: Reno, Nevada, USA

Founded: 2011

Employees: Approx. 100

Revenue (2024): Approx. $15 million (est.)

Overview: Builds an integrated circular battery supply chain in the U.S.

Key Region: North America

Region | Key Drivers | Dominant Companies |

North America | EV growth, U.S. battery laws | Li-Cycle, Redwood, ABTC |

Europe | EU Battery Directive, Green Deal | Umicore, Fortum, Duesenfeld |

Asia-Pacific | EV boom, industrial battery waste | Ganfeng, SungEel, TES-AMM |

Would you like me to add more details on specific companies or market trends? Let me know! CLICK HERE

Intellectual Market Insights Research is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.